If you are a Remote Seller use form 01-798 Remote Sellers Intent to Terminate Use Tax Responsibilities to end your tax responsibility. File a Sales Tax Return - Contact Information You must provide the contact information for the individual filing this return.

Return On Sales Freshsales

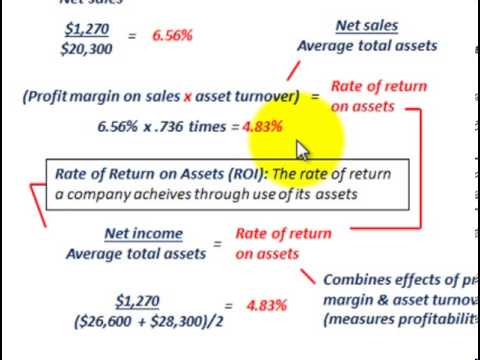

Asset Turnover Ratio Profit Margin On Sales Ratio Rate Of Return On Assets Roi Youtube

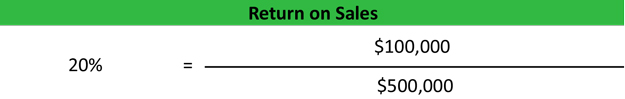

What Is Return On Sales Ros Definition Calculation Usage

Guide to Completing the Provincial Sales Tax Return.

Return on sales. Do not write in shaded areas. 1119 Form ST-9 Virginia Retail Sales and Use Tax Return For Periods Beginning On and After January 1 2020 All Form ST-9 filers are required to file and pay electronically at wwwtaxvirginiagov. Contact us at the address or phone numbers indicated in the instructions.

To put it in other words it is the journal which is used to record the goods which are returned by the receiver or goods. You may not receive a notice to remind you to file your return or pay your tax so its important to remember the due dates. A final sales tax return within 15 days of the sale or closing.

Sales Return Journal Entry Definition. This sales return is account differently from the. Do not staple or paper clip.

Return On Sales - ROS. See instruction s Form 01-922. Filing your return online is an easy and effcient method of fling your sales and use tax return.

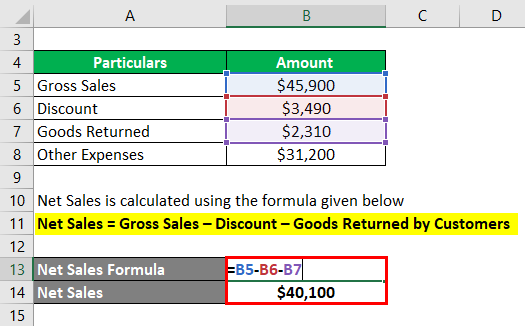

See ST-9A Worksheet for return completion instructions. A Sales Tax return is the taxpayers document of declaration through which taxpayer not only furnishes the details of transactions during a tax period but also deposits his Sales Tax liability. The debit to sales returns reduces the value of sales and at the end of the accounting period will reduce the sales credited to the income statement.

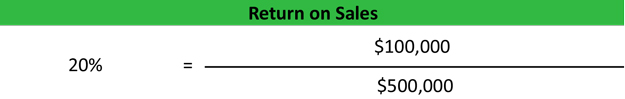

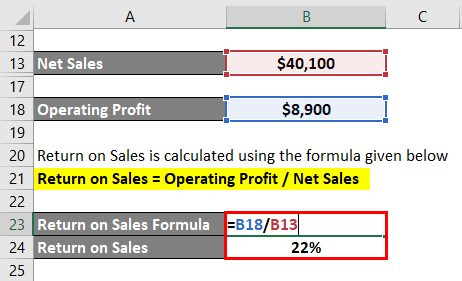

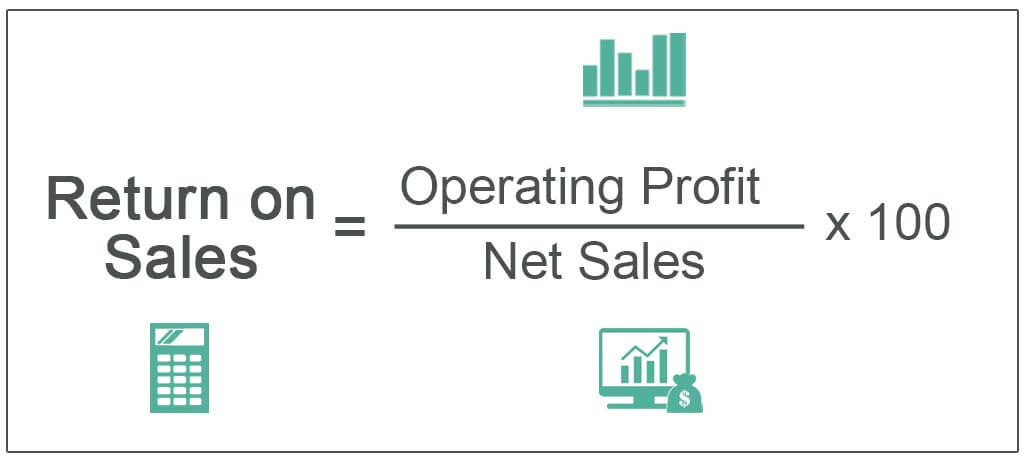

Return on sales is an important metric with a variety of applications. Filing online is quick and easy. Return on sales ROS is also known as operating profit margin Operating Profit Margin Operating Profit Margin is the profitability ratio which is used to determine the percentage of the profit which the company generates from its operations before deducting the taxes and the interest and is calculated by dividing the operating profit of the company by its net sales.

Filing a Final Sales Tax Return Tax Bulletin ST-265 TB-ST-265 Printer-Friendly Version PDF Issue Date. 2019 ST-1 Created Date. Call us toll-free in Canada at 1 877 388-4440 or email us at CTBTaxQuestionsgovbcca FIN 400WEB.

2 Timely Payment Allowance Multiply total amount of tax by 2 and enter the amount on this line. The individual must be authorized to discuss the confidential information provided in the return. If the return is late the discount is not allowed.

Annual calendar year 2020. Return on Sales Ratio Calculator. You will need the dollar amount of.

ROS is also known as a firms operating profit margin. Sales Tax Return Filing Due Dates. Debit The goods are returned and the asset of inventory increases.

Sales Return in terms of payroll journal entry can be defined as that the one which shall be used to account for the customer returns in the books of account or to account for when there is a return of goods sold by the customer due to defect goods sold or misfit in requirement of the customer etc. 7192019 101330 AM. Total sales including leases and rentals sourced to Georgia.

ST-1 Sales and Use Tax and E911 Surcharge Return For Reporting Periods January 2019 and After Did you know you may be able to file this form online. Sales and Use Tax and E911 Surcharge Return Keywords. Hence accounting for sales return is important in this case.

If youre interested in a return on sales ratio calculator to make finding yours a little easier heres one from Omni Calculator. Sales Return Bookkeeping Entries Explained. Sales and Use Tax Return.

The guide is available online at govbccapst under Report Pay or from your local Service BC Centre. Instructions for Filing an Amended Texas Sales and Use Tax Return -. Sales and Use Tax or blacken the box to the right of the signature line on this return.

Read more since it. As a business owner its crucial that you have a picture of yours. A business that is authorized to collect sales tax in New York State must report and remit any sales tax collected during each sales tax period in which it has a valid Certificate of Authority.

Sales Return Journals in Accounting A Return inward Journal or sales returns journal or sales credit daybook is a prime entry book or a daybook which is used to record sales returns. Line 2 Subtract. Texas Sales and Use Tax Return.

Preparing to file a sales and use tax return on GTC. Click here to go to MyTax Illinois to file your return online. December 2020 monthly and quarterly January 20 2021.

We no longer mail tax returns to businesses. You have certain rights under Chapters 552 and 559 Government Code to review request and correct information we have on file about you. Sales return is the transaction or event when customers return purchased goods back to the company due to various reasons such as the wrong product late delivery or the goods are damaged or defective.

Updated June 13 2014 Introduction. Return on sales often called the operating profit margin is a financial ratio that calculates how efficiently a company is at generating profits from its revenue. Return on sales ROS and the operating margin are very similar profitability ratios often used interchangeably.

Sales Subject to County Sales Tax County Name first 5 letters Wisconsin Sales and Use Tax Return Form ST-12 Wisconsin Department of Revenue State County and Stadium Sales and Use Tax Use BLACK INK Only Check if this is an amended return Check if address or name change note changes at left Check if correspondence is included Sales Subject. The following guidance applies to completing a sales and use tax return ST-3 on GTC for sales that occur on or after April 1 2018. The key difference is the.

Sales exempt from state sales and use tax. You are responsible for filing a return by the due date. In other words it measures a companys performance by analyzing what percentage of total company revenues are actually converted into company profits.

Click here to download the pdf form. On the return form the taxpayer declares for a particular tax period and respective input tax and output tax at prescribed rate of Sale Tax. When you fle your return online with the California Department of Tax and Fee Administration CDTFA the system calculates tax due based on the sales and deduction information you enter.

Effective January 1 2021 the city tax rate has decreased to 307 for all transactions occurring on or after that date. Returns must be filed even if no tax is due to city. Return on sales ROS is a ratio used to evaluate a companys operational efficiency.

You will only need to. Sales return is the return of products or commodities by customers to the seller due to many reasons but usually within some agreed time period and due to the condition of the product and customers satisfaction.

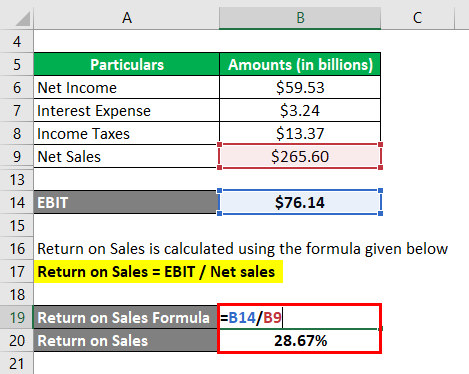

Return On Sales Formula Calculator Examples With Excel Template

Return On Sales Formula Other Thing You Ll Need To Know Avada Commerce

Return On Sales Ratio Formula Analysis Example

Return On Sales Freshsales

Ros Return On Sales Unigiro Regtech

Return On Sales Examples Advantages And Disadvantages

Return On Sales Examples Advantages And Disadvantages

Return On Sales Meaning Example How To Calculate